do nonprofits pay taxes on investment income

Non-profit Tax-Exempt Status. 20 2019 the excise tax is 2 percent of net investment income but.

How To Install Use Loyverse Pos On Your Computer Laptop Techforpc Com Software Apps Point Of Sale Retail Pos System

If you operate or manage a nonprofit you should.

. However they arent completely free of tax liability. Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is not considered UBTI and therefore is tax exempt. Ad Discover Why Endowments And Foundations Trust Vanguard.

This guide is for you if you represent an organization that is. Being required to pay capital gains tax if a certain investment is. Tax-exempt organizations report their income from stock investments on Form 990 which is the annual informational return tax-exempt organizations must file.

The full Form 990 is for non-profit organizations with gross receipts greater than or equal to 200000. However Private Foundations will pay tax on investment income if they do not distribute sufficient funds for charitable purposes during the year. In short the answer is both yes and no.

Which Taxes Might a Nonprofit Pay. If the foundation sells or otherwise disposes of property used in the production of. For tax years beginning on or before Dec.

But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Internal Revenue Code Section 4940 imposes an excise tax on the net investment income of most domestic tax-exempt private foundations including private operating foundations. Answer 1 of 5.

Given their status as a 501c3 entity nonprofits are provided an income tax exemption that applies to their investment portfolio. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates. Perhaps the most impactful investment characteristic of a non-profit organization is its tax-exempt status.

There are certain circumstances however they may need to make payments. Do nonprofits pay income tax on investments. There are some instances when nonprofits and churches are still required to pay taxes.

Investment income is reported on Line 10 of. Many nonprofits hold stocks in their endowment accounts. The major sub-sectors where investment income exceeds 5 percent of income are artsculture education health care disease-related organizations public safety and disaster relief youth development human services community improvement research.

An exempt operating foundation is not subject to the tax. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for the production of income. It is intended to prevent tax evasion by US.

Then theres Form 990-N commonly known as an electronic postcard which is for nonprofits with gross. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Form 990-EZ which is a much shorter version of the main form is for nonprofits with gross receipts between 50000 and 200000.

For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. In general 501c3 charities do not pay tax on capital gains. The tax rate on capital gains for most assets held for more than one year is 0 15 or 20.

Below well detail two scenarios in which nonprofits pay tax on investment income. Generally the first 1000 of unrelated income is not taxed but the remainder is. Excluding foundations one in five nonprofits receives at least 5 percent of its income from investments.

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Do nonprofits pay taxes. Tax on Net Investment Income.

And the IRS doesnt treat profits the nonprofit earns from investments differently than other donations. Which Taxes Might a Nonprofit Pay. UBI can be a difficult tax area to navigate for non-profits.

Although 501c3 organizations dont pay tax the IRS requires them to report revenue and expenses just like a company that is subject to tax. Nonprofit organizations must file returns and payor collect and remit taxesfor some tax types in Vermont. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is not considered UBTI and therefore is tax exempt. For the most part nonprofits are exempt from most individual and corporate taxes. Do nonprofits pay taxes on investment income.

Any nonprofit that hires employees will also. Tax-exempt organizations are eligible to make investments in stocks bonds and other financial instruments. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act.

Nonprofits should not assume that just because they have obtained tax-exempt status at the federal level through the IRS they do not need to pay or remit any taxes in Vermont. Monday April 25 2022. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

In short the answer is both yes and no. This includes capital gain dividends received from a regulated investment company. Investment income may also be subject to an additional 38 tax if youre above a certain income threshold.

Fiduciary Support That Frees You Up To Focus On What Matters MostAdvancing Your Mission. Although dividends interest rents annuities and other investment income generally are excluded when. Up to 25 cash back While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

Get Your Business Funded Creative Methods For Getting The Money You Need Paperback Walmart Com Business Funding Peer To Peer Lending Raising Capital

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Worksheets Budgeting

Smart Ways To Give To Charity At Year S End This Retirement Life Donate To Charity Charitable Gifts Charity

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Worker Cooperative Economics Cooperation

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

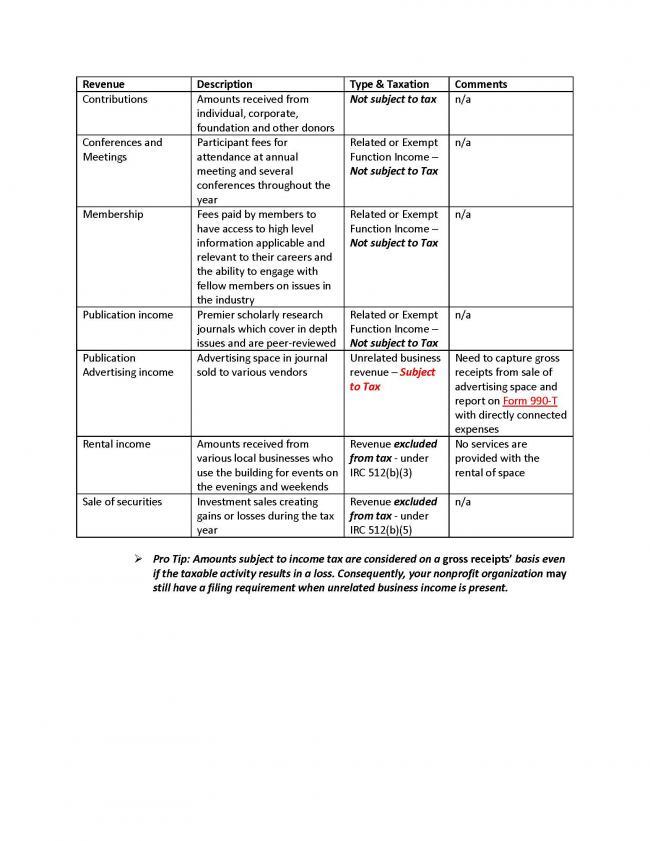

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Income Tax Exempt Organisations Australian Taxation Office

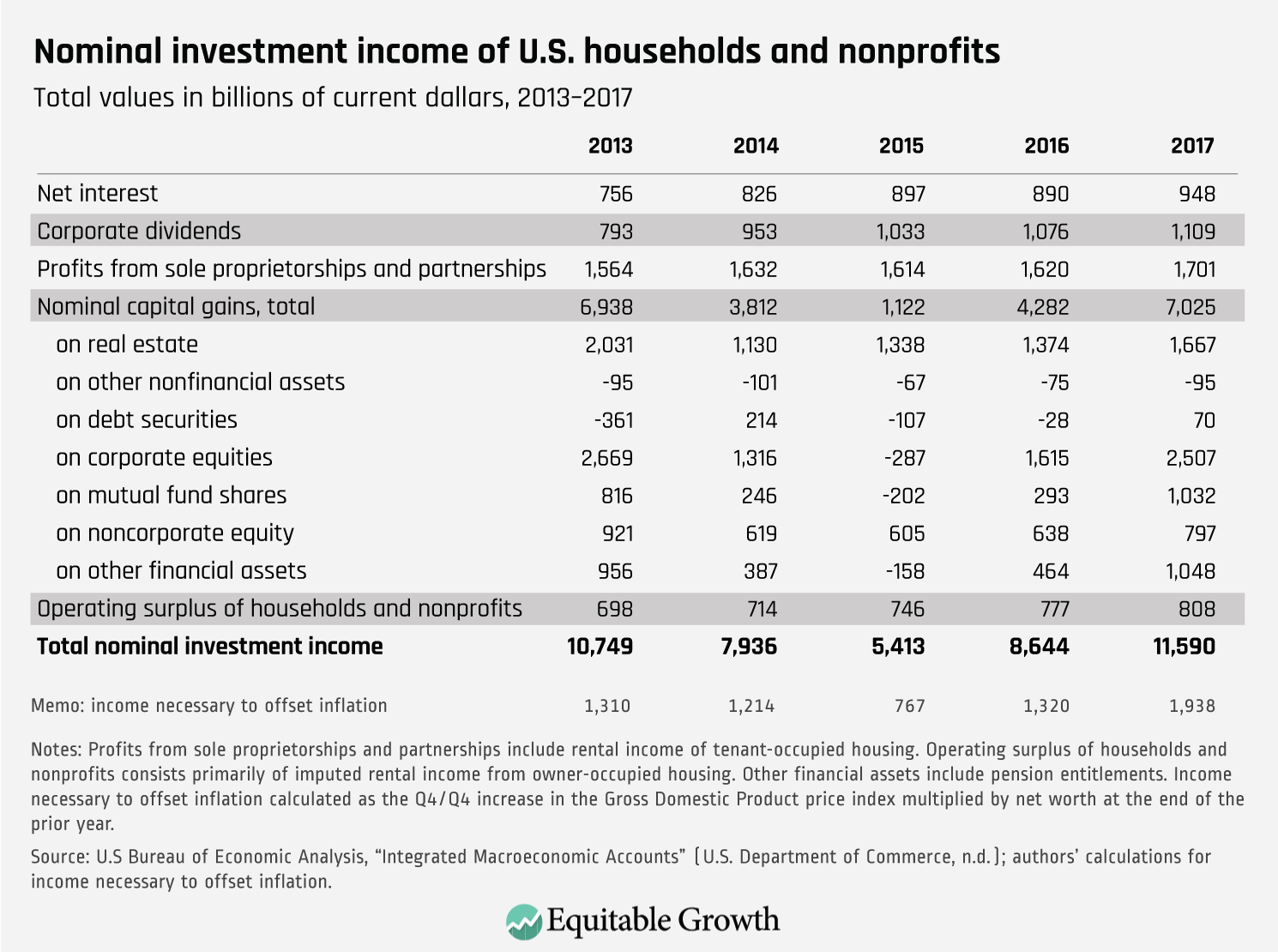

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

Benefits Of Bookkeeping Bookkeeping Accounting Finance

Our 2013 Rental Profit Loss Statement Schedule E Http Www Rentalrealities Com 2013 Profitloss Sta Profit And Loss Statement Good Essay Bookkeeping Business

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

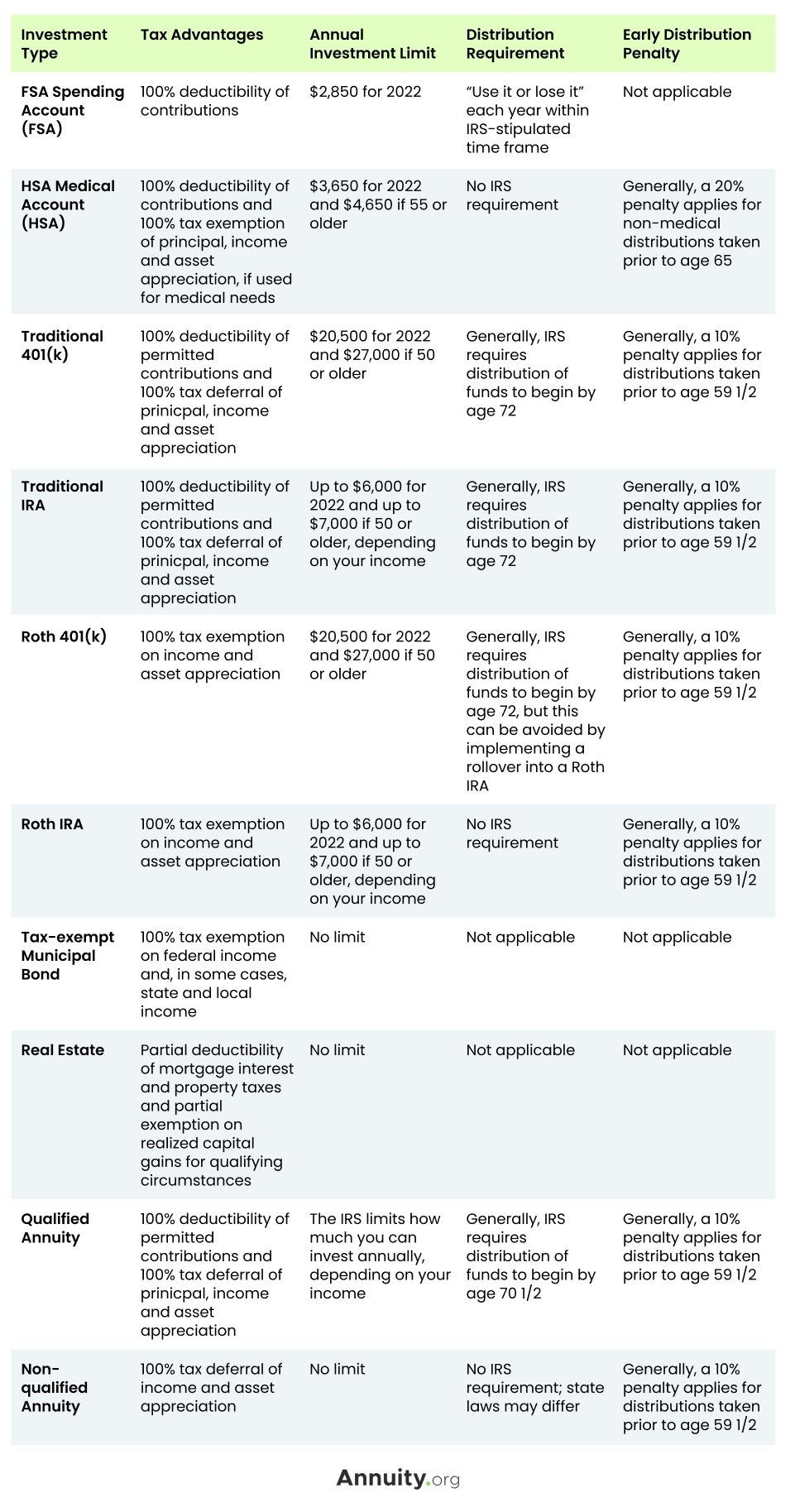

What Are Tax Sheltered Investments Types Risks Benefits

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Legalsalah Official Legalsalaho Twitter

How Does A Nonprofit Obtain Tax Exemption Status The Sterling Firm

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)